What is Multi-Chain DeFi lending?: A Deep Dive Into Maximizing Your Assets

Decentralized Finance (DeFi) has opened new avenues for maximizing your assets by giving users a permissionless and strictly peer-to-peer system. Among all of the decentralized applications (DApps), Defi has the highest lending growth rate and is the most prevalent contributor for locking crypto assets.

In this article, we focus on multi-chain DeFi lending and how it works. We are going to discuss in detail what goes on in these transactions and include the benefits of DeFi lending and borrowing.

What is Multi-chain DeFi Lending?

Web 3.0 is a multichain mosaic, and the winning DeFi projects are those that build experiences connecting as many blockchains as possible. There are many ways to earn money through DeFi, like staking, lending, and yield farming, and multi-chain DeFi lending aims to combine these types of earning and make them work for the users simultaneously to get greater yields. You will get a stable coin in return by staking your assets into one of these platforms, which you can then use for staking on other platforms. As a result, projects/platforms that support multiple chains gain larger audiences and more liquidity.

The idea is to make the users earn at the same time across different platforms to maximize yields. You can already earn from staking the initial assets in exchange for stable coins. The earning opportunities don’t stop there because you can exchange the stable coins you now have for various assets like $ETH, $BNB, $CAKE, $AVAX $MATIC you can stake on other platforms.

Understanding DeFi Lending and Borrowing

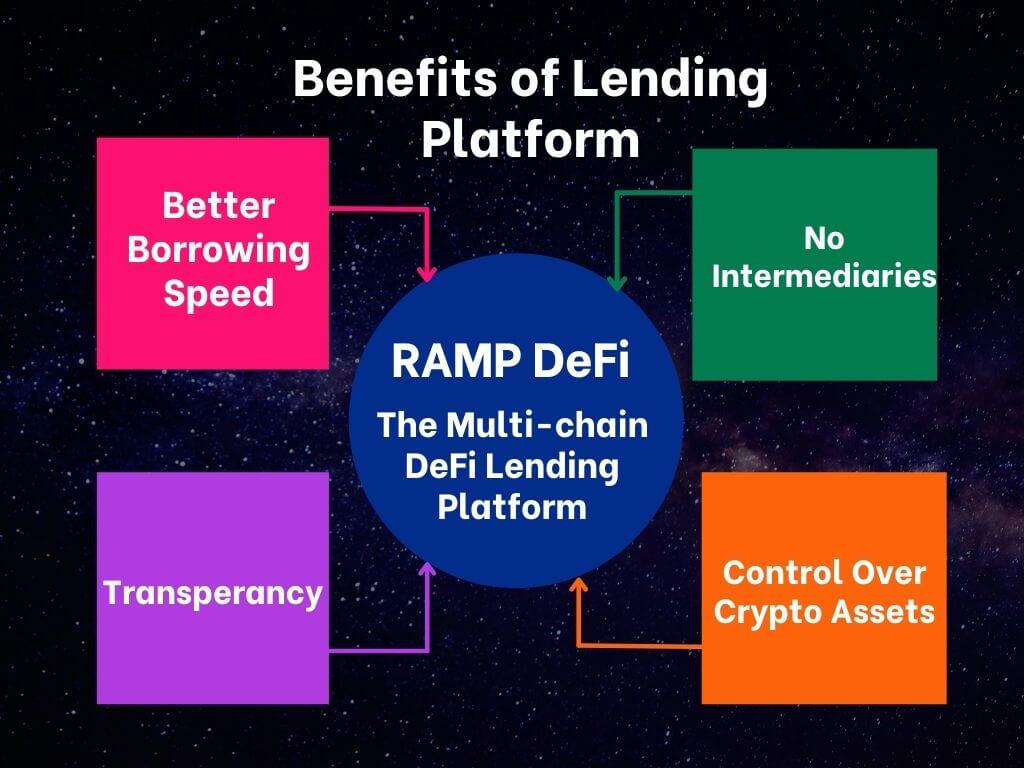

DeFi lending and borrowing occurs thanks to the lending platforms or protocols, for example RAMP DeFi. On these platforms, a borrower can take a loan, allowing the lender to earn interests once the loan is returned. The lending process is executed from the start till the finish without intermediaries.

A coin holder sends the tokens they intend to lend into a pool using a smart contract. Once the coins are sent to a smart contract, they become available to other users to borrow. Afterward, the smart contract issues tokens (usually, the platform’s native token) that are doled out automatically to the lender. The tokens can be redeemed at a later stage in addition to the underlying assets that were sent to the smart contract.

Benefits of DeFi Borrowing

Virtually all the loans issued via the native tokens are collateralized. This means users who wish to borrow funds will need to provide a guarantee. However, unlike the centralized financial system, the guarantee in the DeFi space is in the form of cryptocurrencies that are worth more than the actual loan itself.

There are numerous reasons why DeFi borrowing makes sense.

-

The users might require funds to take care of unforeseen expenses they may have incurred and don't intend to sell their holdings as they believe the assets are due to an increase in value in the future.

-

By borrowing money via DeFi protocols, users can avoid or delay paying capital gains taxes on their cryptocurrencies.

-

Users can use the funds they borrow from the DeFi protocols to increase their leverage on some trading positions.

How DeFi Loans Work

DeFi loans are the foundation of multi-chain DeFi lending. They try to emulate how banks deal with loans on their end, by asking for collateral from their borrowers. Collaterals can come in the form of a different token with a higher amount compared to what is being borrowed, to ensure security.

Lenders can deposit fiat money to a DeFi lending platform, and they can increase their assets by earning interest. DeFi lending platforms are policed by Smart Contracts, a set of codes that regulate and enforce a system that guarantees similar results every single time.

Conclusion

DeFi is a revolutionary concept that quickly rose to popularity. The introduction of multi-chain lending that gives users the power to get additional assets from different sources at the same time. If we compare the crypto landscape from when it began to now, we can genuinely say that it is going in the right direction. DeFi lending and borrowing platforms provide several benefits that users can’t get enough of. Every day, companies and businesses are looking to develop their DeFi lending protocols and reap the rewards. Hence, if you want to tap into this lucrative industry, then now is the time to do it.

One such platform that allows multi-chain lending is RAMP. Ramp DeFi allows its users to borrow rUSD, a stable coin that can be used seamlessly for lending or staking on other platforms and protocols. Ramp, together with dApps such as Polygon, Quickswap, Pancakeswap, Avalanche and Ethereum makes life easier for investors to maximize their assets.

Join the RAMP Community

Backed by world-class investors, RAMP DEFI is an optimized lending platform that aims to give users the highest deposit yields and lowest borrowing fees on collateral assets within Binance Smart Chain and Polygon.

Using the RAMP solution, users with staked assets can continue to receive staking rewards, retain capital appreciation potential on their staked portfolio, and unlock liquid capital to invest in new opportunities at the same time.

The RAMP Token is accessible on:

Binance | FTX (Futures) | PancakeSwap | Uniswap | Gate.io | MXC | Bittrex

If you are interested to participate in our community and receive timely updates from the following official channels:

Twitter | Telegram | LinkedIn | Discord | Medium | Reddit |

For partnerships, media, or other collaboration opportunities, please email team@rampdefi.com